Shares of Amarin Corporation PL.C. (NASDAQ:AMRN) rose 10.49% yesterday on 3X normal volume to close at $9.16 per share. AMRN increased because of a combination of a daring options play, impending Orange Book update, and unusual media attention as we explain herein.

Big Options Bet

Media Attention

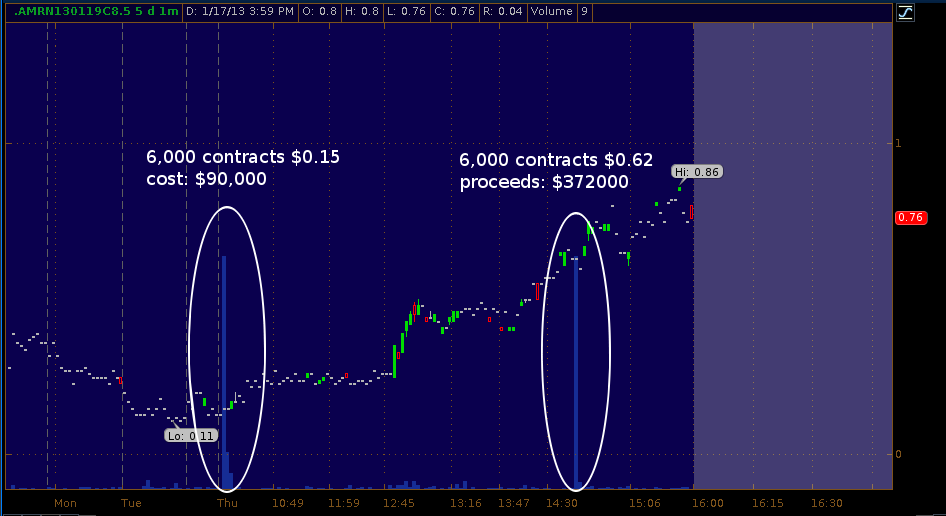

What's most interesting about the chart above is that the large spike in bid/ask occurs at 12:59pm. This corresponds to the end of the CNBC Fast-Money Half-Time Report, a mid-day show covering market activity. During the last minute of the show, each trader calls out a "final trade" - i.e. a trade they are in or are watching based on the days developments. Option trader Jon Najarian's pick yesterday was AMRN. He noted the large options bet from earlier in the day and indicated that "I followed him in." Once Najarian made this comment, both AMRN's stock and the options exploded to the upside. Below is AMRN's 1-day chart for Thursday.

CNBC has wide syndication of their content. Their videos show up on many trading platforms and now even syndicate to Yahoo Finance. Within minutes of the trading call by Najarian, this video made the rounds on these syndicated distribution channels assuring further activity in AMRN.

Conclusion

As seen from the intra-day $8.50 strike call trading chart, at 2:40 pm, another 6,000 contracts of the $8.50 calls traded hands for $0.62. This morning, the open interest in this strike stands at 3,115 contracts despite yesterday's volume of 17,681 contracts. The 2:40pm trade was a reversal of the trade made in the morning. Assuming that all 6,000 contracts were bought at 15 cents and sold at 62 cents, a 1-day profit of $282,000 was realized on the $90,000 bet.

We believe that this trade did not involve any fore-knowledge of whether or not Amarin is receiving a decision on its pending request for New Chemical Entity Status with the FDA. As soon as AMRN stock made a large upside move yesterday afternoon, twitter and stocktwits were flooded with messages about "someone knows something" and "NCE is going to be answered tomorrow" etc.

In reality, this well-orchestrated options trade shows that the trader knew a lot about retail investor psychology, specifically in AMRN, and was able to take advantage of this psychology to make a profitable trade. By making a huge bet in out-of-the-money calls, the option trader created the impression that someone had inside knowledge. Whether or not anyone outside of FDA knew the answer to the NCE decision yesterday, the appearance that someone knew was all that was needed to move the options in the right direction. The extra media attention from Jon Najarian was likely an unexpected bonus. Even before the Fast-Money shout out, the options had appreciated by 60%. The media attention simply served to foment additional speculation by retail investors who then drove up the price of the stock and the options much higher than perhaps otherwise would have happened.

By the end of the day today, everyone will know whether or not AMRN received their answer from FDA when the December orange book update comes out. We currently have no view on whether or not Vascepa receives NCE designation. Should NCE be granted, AMRN stock has room to move to $12 before encountering real overhead resistance. Should NCE status be denied, downside support is at $7 and then at $5; however, either way, the overhang of NCE will be removed. As we have many times in the past, we caution investors who continue to hope for a buyout in the near term that the timing for a buyout, after approval and before proven sales for Vascepa, would be an exception and not the norm. If Vascepa's drug launch goes slower than expected, a potential acquirer will get a better price by waiting. If the launch is better than expected, an acquisition that prices in the ANCHOR indication is further de-risked. In either case, there is little benefit for the acquiring firm to act now.