Real Life Left Twix Vs. Right Twix, A Story of Sneakers and Stocks

I have a TON of candy leftover from halloween. One thing that caught my eye was the mini Twix bars. Each mini bar wrapper has a label saying either Left Twix or Right Twix.

A Decade Long Brand Marketing Campaign

The "Left Twix Vs. Right Twix" Campaign is a decade long marketing campaign by M&M Mars first launched in 2012.

The campaign's goal was to refresh the Twix brand and make it relevant to a whole new generation of candy lovers.

The original ad spot told of 2 inventors Seamus and Earl who together created the candy bar.

But behind the scenes, things were at a breaking point. The two inventors could not agree on anything.

They soon decided they couldn't work together anymore.

Each partner decided to go their own way and built their own factory. One producing Left Twix Cloaked in chocolate. The other producing Right Twix covered in chocolate.

(images from youtube: https://www.youtube.com/watch?v=HtWavRpVzDQ)

This marketing campaign was tongue-in-cheek. But the company succeeded in making the Twix brand more relevant and more talked about.

A search on the internet will show lots of video, blog posts and article dedicated to talking about Left Twix Vs. Right twix. That's a sure sign of a successful marketing campaign.

Real Life Origins

Did you know that there is a real-life story that was (one of) the inspirations for this Marketing campaign?

Meet the Dassler Borthers, Rudolf and Adolf.

In pre-WWII Germany, these two brothers started the Dassler Borther's Shoe Factory.

The war interfered with their business plans. Each brother was conscripted into the German Army. But Adolf managed to get special leave to run the factory.

After the war, the brothers returned to business.

A Family Feud

By 1948, there was a full-fledged Feud brewing between Rudolf and Adolf. Some say Rudolf accused Adolf of lying to the Allie that he was a Nazi SS spy leading to the rift. Others claim that the brothers' wives hated each other and this caused the Feud.

Whatever the cause, the brothers decided they could not work together anymore.

They decided to break up the family business and go their separate ways.

The Brothers Go Their Separate Ways

After dividing up the company assets, the brothers each started their own company.

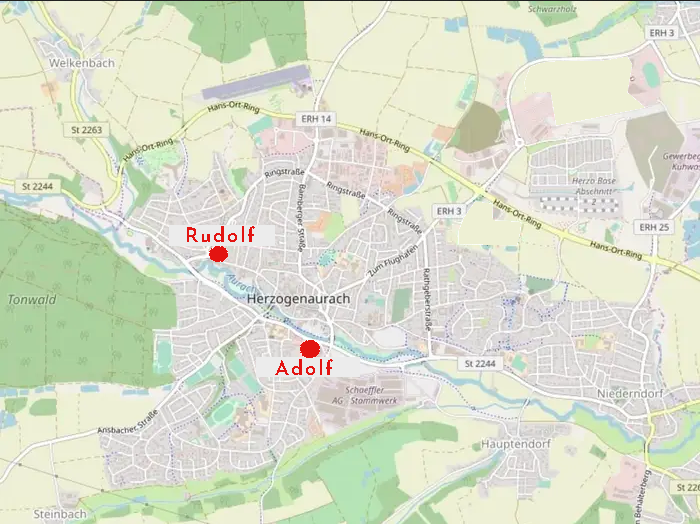

Adolf kept 1 factory, and Rudolf moved across the river and got the other factory. Is this beginning to sound familiar?

New Companies Need Names

Each brother needed a new name for his new company.

Elder brother Rudolf named his company using initials from his first and last name. He called it 'RuDA"

You've [probably] never heard of Ruda, and we will revisit Rudolf's company in a minute. But first, Let's talk about Adolf.

A Brand is Born

Much like his brother, Adolf decided to name his company after himself. His nickname among family and friends was 'Adi'. He combined this with the first 3 letters of his last name and named his company:

Adidas

(image source: wikimedia)

That's right. The international sportswear brand Adidas gets its name from it's founder, Adolf Dassler.

Adolf Dassler's new company was a smashing success. Adidas is one of the largest sportswear brands in the world.

By the way, November 3rd is Adolf Dassler's birthday - Happy Birthday Adolf.

What about Ruda?

Remember how I said Rudolf names his company RuDa?

That name didn't last very long.

Together with his son who joined him in business, they chose a more memorable and iconic name. Rudolf Dassler's company change it's name to...

Puma

(image from wikimedia)

Both Dassler brothers had phenomenal success with their companies after splitting up.

We can see the seeds of the Left Twix - Right twix marketing campaign in the Dassler Borthers' story. The parallels are too uncanny for this to be a coincidence.

To This day, both Adidas and Puma have their world headquarters in the small German town.

Which Twix Did Better in 2020 - 2021?

The true-life origin story of Adidas and Puma begs the question. Which real-life twix performed better after the coronavirus pandemic?

Did Left twix (Adidas) beat Right Twix (Puma)? Or was it the other way around?

American Depository Receipts (ADRs) for Adidas' trade under the ticker symbol 'ADDYY'. Puma's ADRs trade under the symbol 'PUMSY'

Team Left Twix (Adidas)

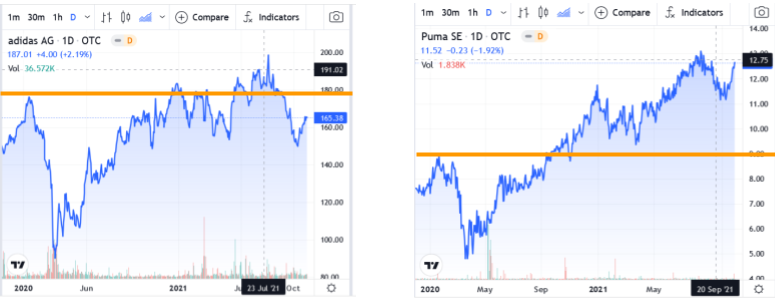

Take a look at the for Adidas chart below:

Let's say you were quick (and brave) in March 2020. You bought Adidas for $96 per share. A GREAT entry point.

Now if you held the stock for a little over a year. You could have sold this past summer for about $191 per share.

That's an amazing 99% Gain. Go Team Left Twix!

Beat THAT! Right Twix!

Team Right Twix (Puma)

Here is Puma's chart for the same time period.

Again, let's say you were both smart and brave. You bought PUMSY for $5 per share when everyone else was panicking. And hoarding toilet paper.

After holding for a little over a year you sell this past summer for $12.75.

That's a whopping 155% gain.

Team Right Twix for the win!

Why The Difference in performance?

Things become a bit clearer when we look at the charts side by side. (Note, watch the video for a detailed analysis.)

(charts by tradingview via protifpotlines.com)

Adidas is on the left and Puma is on the right. The orange lines on each chart show the pre-pandemic price level of the stock.

Notice how Adidas recovered to pre-pandemic levels, but it's stock price didn't really gain anything more than that.

Puma's stock price however, recovered to pre-pandemic levels by September 2020 and then kept going up. By August 2021, Puma's stock price was 30% higher than pre-pandemic levels.

Could You Anticipate This?

As an investor, the key question is - how do you figure out that Puma will out-perform BEFORE the stock moves happen? In other words, back in March 2020, was there a way to predict that Puma would deliver a better return than adidas..

I turns out, There IS a way to make these kinds of predictions.

Following The Plotlines

There is a fairly simple yet powerful set of metrics that would have told you to favor Puma over Adidas back in March 2020. Making stock picks like this, well in advance of large stock moves is the subject of my upcoming book.

It's called Profit Plotlines.

Inside this new book I reveal a radically simple yet powerful way of looking at the markets and anticipating big stock moves weeks before they happen. This new way of looking at the markets let's you trade like you've seen the movie before.

I explain the Puma vs Adidas choice inside the book along with dozens of other examples that help you understand the markets.

This way of picking winning stocks has nothing to do with chart patterns or technical indicators or anything like that. It's a much simpler and more powerful method of analysis that has newer been taught before.

Join The Pre-Launch

Right now, I'm still doing some final edits to the chapters to make sure everything flow and the teaching is as natural as possible. The official release of the book is still a few weeks away. But right now we are in Pre-Launch.

If you visit profitplotlines.com you can join the pre-launch list.

Learn how to pick Pumas over Adidas

When you join the pre-lanch, a lot of cool things will happen:

- You will get access to exclusive content ONLY for pre-launch members

- You'll get to VOTE on the final book cover design

- Get a private invitation to the Live Stream of the Video Course (Pre-orders only)

- You'll win the love and admiration of your friends and neighbors

- Traffic lights will turn green for you more often

Okay, I can't guarantee that last one, but everything else on that list is true,

so if you don't want to wait until the book comes out to answer how you could have picked Puma over Adidas - head over to profitplotlines.com and get on the pre-launch list.